On July 4th, Congress passed the One Big Beautiful Bill Act (OBBBA), a sweeping new tax law that reshapes many deductions, credits, and planning strategies for individuals, families, and business owners. While some provisions are straightforward, others require additional IRS clarification that we are still waiting on. Here’s a breakdown of the highlights and what they could mean for your financial plan.

Expanded & Extended Tax Brackets

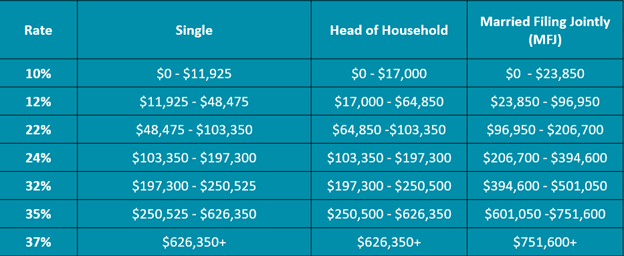

- The Tax Cuts and Jobs Act (TCJA) rates were scheduled to expire at the end of 2025. OBBBA makes those lower rates permanent (for now).

2025 Federal Tax Brackets:

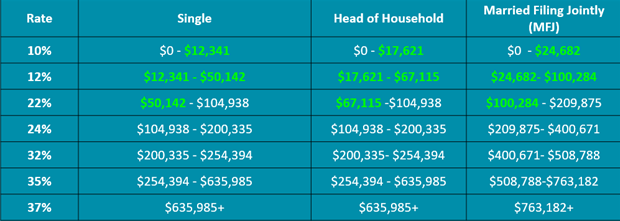

- The 10% and 12% brackets are expanded with double inflation adjustments for 2026. While this benefits taxpayers by allowing more income to be taxed in the lower tiers, it creates a smaller 22% tax bracket.

Estimated 2026 Tax Brackets:

- For most taxpayers, this means modest annual tax savings, though high earners may see less benefit.

Higher Standard Deduction

- In 2025, the standard deduction rises to $15,750 for single filers and $31,500 for married filing jointly.

- For those age 65 and older, there’s a new additional deduction of $6,000 per person (on top of the existing age-based increase).

- To qualify, MAGI must be under $75,000 for a single filer or $150,000 for Married Filing Jointly. Above the MAGI limits, the additional deduction begins to phase out.

- A married couple over 65 could see a standard deduction as high as $46,700.

- This higher threshold means itemizing deductions will become even more limited. It will be important to review strategies around charitable gifting and other potentially itemizable deductions.

Key Itemized Deduction Changes

- Charitable Contributions: The 60% AGI limit is made permanent. However, starting in 2026, the first 0.5% of AGI in contributions will be excluded from Schedule A.

- New “Below the Line” Deduction: Beginning 2026, taxpayers can deduct up to $1,000 (single) or $2,000 (married) for charitable contributions even if they don’t itemize. These contributions must be made in cash to a Section 509(a)(3) “supporting organization” or used to establish or maintain a donor-advised fund.

- SALT Deduction: The state and local tax cap rises from $10,000 to $40,000 (with 1% annual increases through 2029). Phaseouts will be implemented for taxpayers with $500,000 or more in AGI with a maximum of $10,000 for those with AGI above $600,000.

- Mortgage Interest: Deductible on up to $750,000 in mortgage or home equity loans used to build or improve property. This provision was made permanent.

- Gambling Losses: Limited to 90% of winnings starting in 2026.

- Educator Expenses & Casualty Losses: Added back as allowable deductions.

- Cap on Itemized Deductions: Overall tax benefit is capped at 35% starting in 2026. This provision only impacts those in the highest, 37%, tax bracket.

Expiring & Time-Sensitive Tax Credits

- Clean Energy Vehicle Credit: Ends September 30, 2025.

- Energy-Efficient Home Improvements: Credits for windows, doors, insulation, solar, geothermal, etc. expire December 31, 2025. Work must be completed by year-end to qualify.

- New Credit Coming: An energy-efficient home credit starts mid-2026, creating a six-month gap where no credit applies.

Newly Created Deductions

- Auto Loan Interest: Up to $10,000 of annual interest is now deductible if the vehicle meet certain criteria. This applies to cars, vans, SUVs, pickups, and motorcycles that are new and assembled in the U.S. The loan must originate after 12/31/24, either new or refinanced.

- Tips Income: Up to $25,000 excluded from taxable income; phaseouts apply above $150k single / $300k joint. This provision is set to expire after 2028. The IRS will publish a list of occupations that will qualify.

- Overtime Pay: The “extra” portion of overtime wages (above base pay) is deductible up to $12,500 single / $25,000 joint. The deduction phases out for taxpayers with over $150k single / $300k MFJ of AGI. Payroll taxes and state income taxes will still apply. This provision expires in 2028.

Business & Retirement Provisions

- Qualified Business Income (QBI) Deduction: The 20% deduction that was introduced by the TCJA was made permanent.

- Bonus Depreciation: 100% bonus depreciation continues for qualifying purchases.

- Student Loans: Employer contributions toward student loan repayment remain excluded from taxable income, up to $5,250 per year.

- 529 Plans: Expanded to cover K–12 expenses beyond tuition (e.g., books, tutoring), up to $20,000/year per beneficiary.

- Contributions to Scholarship Granting Organizations: Contributions, starting in 2027, to Scholarship Granting Organizations (SGOs) qualify for a new Federal tax credit, up to $1,700, if you do not receive a state income tax credit.

- Estate Tax: Exemption increased to $15 million per person in 2026 (or $30 million for married couples).

The “Trump Account”

- Launches in 2026, with contributions up to $5,000 annually per child under 18.

- No upfront deduction (similar to a non-deductible IRA). Earnings are tax-deferred.

- Withdrawals before 59½ face penalties.

- Government “kickstart” of $1,000 for children born 2025–2028.

- Investment options limited to U.S. index-tracking mutual funds and ETFs.

While it could provide another tool for families, its restrictions mean other accounts (like Roth IRAs for working teens) may be more flexible.

Planning Opportunities to Consider

The OBBBA creates both opportunities and challenges. You may want to talk with your advisor if you are:

- Planning to buy a clean energy vehicle or make home upgrades before the credits expire.

- Making charitable contributions and want know the tax benefits.

- A business owner leveraging the extended QBI deduction.

- Saving for children’s education or using 529 accounts for expanded expenses.

- Considering Roth IRA conversions.

Contact Market Street if you have Questions!

While OBBBA makes some tax rules “permanent,” tax law is always subject to change. What matters most is how these rules apply to your personal situation.

At Market Street Wealth Management Advisors, we believe that personal finance is personal. The OBBBA may lower taxes for some households, but the real value lies in how you plan across multiple years to smooth out tax rates, reduce surprises, and capture opportunities.

Not sure how the OBBBA affects you? Reach out to your Market Street advisor. Together, we can help you understand the changes, update your plan, and take advantage of the new opportunities in this evolving tax landscape.