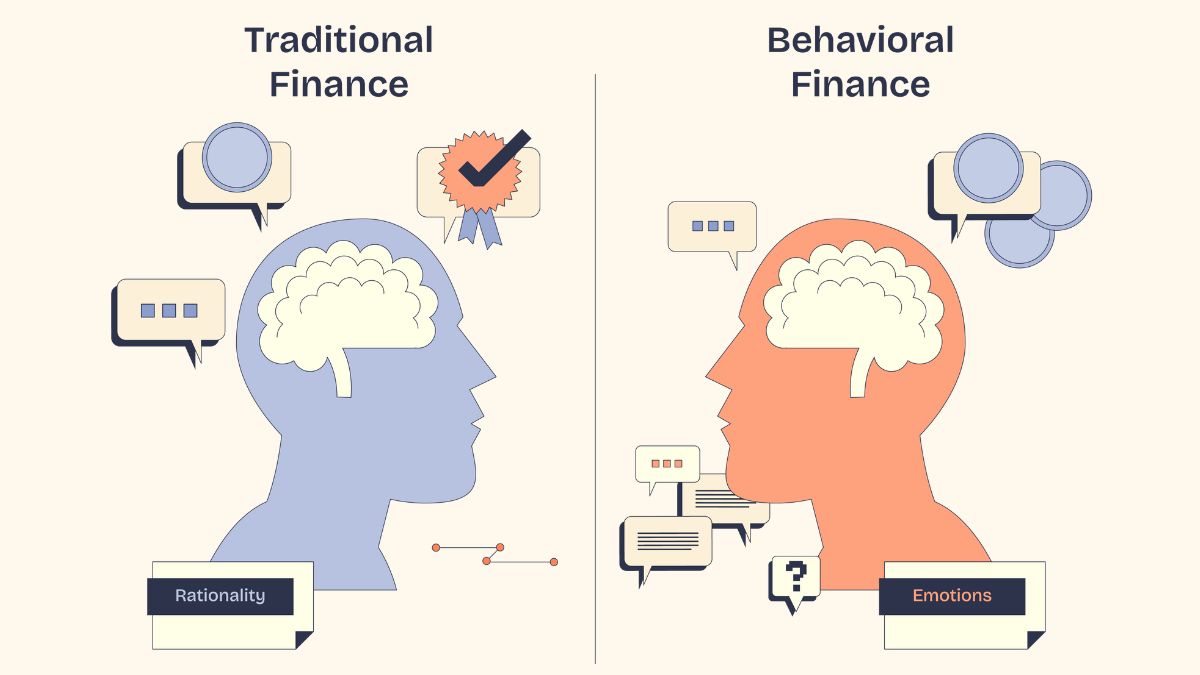

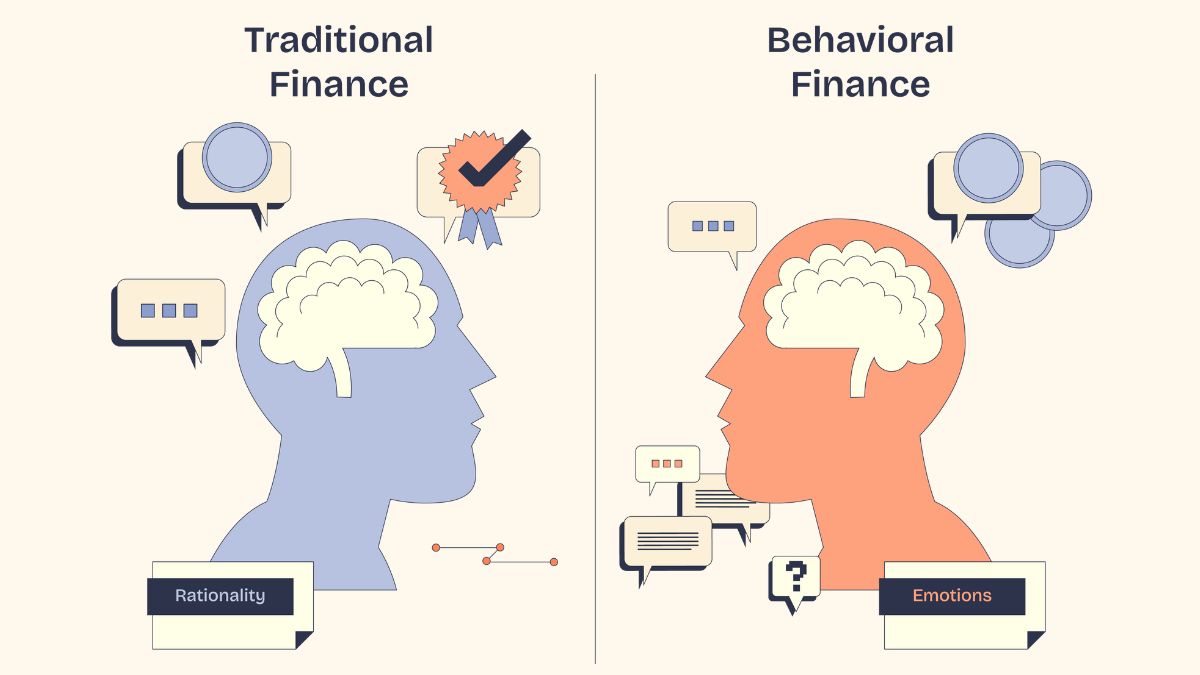

Understanding the Emotions Behind Financial Decisions

February is an interesting month in the financial calendar. The holiday excitement has faded, credit card bills from December have arrived, and tax season is in full swing. For some

Our blog offers insights, strategies, and practical tips to help you achieve financial freedom—no matter your unique financial situation.

February is an interesting month in the financial calendar. The holiday excitement has faded, credit card bills from December have arrived, and tax season is in full swing. For some

Artificial intelligence (AI) may be the most revolutionary technology of our time, with industries scrambling to embrace its possibilities. AI’s early influence seems similar to the positive disruptions brought about

As you gather with family for the upcoming holidays, a growing number of Americans may discuss caring for aging parents around the dinner table. As financial professionals, we have many

If you’ve found yourself stepping into a more active role in your parents’ financial lives, you’re not alone. Some of us are helping aging parents navigate everything from healthcare decisions

On July 4th, Congress passed the One Big Beautiful Bill Act (OBBBA), a sweeping new tax law that reshapes many deductions, credits, and planning strategies for individuals, families, and business

Estate management isn’t just about what happens after you’re gone— it’s also about what you can do now to help manage future estate taxes, transfer wealth strategically, and attempt to

April isn’t just about filing taxes—it’s also Financial Literacy Month, a perfect opportunity to reflect on your financial habits, expand your knowledge, and take meaningful steps toward improving your financial

One of the greatest gifts you can give your loved ones is a thoughtful estate strategy that outlines your wishes after you are gone. Discussing estate details with your team

March is Women’s History Month, and according to a recent survey, 49% of women consider themselves to be the chief financial officer of their households, up from 41% in 2021.1

You’ve worked hard throughout your life to build assets to support your retirement. As financial professionals, one of the most critical functions we provide is helping clients determine their retirement

Tax season brings a new wave of identity theft risks, with criminals ready to exploit your personal data to file fraudulent tax returns in your name. Imagine the shock of

Looks like New Year’s resolutions are still going strong in 2025! A recent Pew survey found that about a third of Americans kicked off the year with at least one