2025 in Review and What to Know Heading into 2026

As we begin a new year and consider the opportunities ahead, reflecting on the past year helps put today’s financial landscape into perspective and informs the strategies that can move

Our blog offers insights, strategies, and practical tips to help you achieve financial freedom—no matter your unique financial situation.

As we begin a new year and consider the opportunities ahead, reflecting on the past year helps put today’s financial landscape into perspective and informs the strategies that can move

As the end of the year approaches, now is the perfect time to review your finances and make strategic moves that can strengthen your financial position heading into 2026. Our

The final months of the year can sneak up quickly, and with them come deadlines, decisions, and distractions. Before the holiday season takes over your calendar, fall can be a

On July 4th, Congress passed the One Big Beautiful Bill Act (OBBBA), a sweeping new tax law that reshapes many deductions, credits, and planning strategies for individuals, families, and business

The rules regarding inherited IRAs have changed in the last five years, and failing to comply with the new requirements may result in IRS penalties. These changes affect people inheriting

Tax season brings a new wave of identity theft risks, with criminals ready to exploit your personal data to file fraudulent tax returns in your name. Imagine the shock of

America is a generous country. People with diverse backgrounds can unite for a good cause, whether to benefit their local communities or the broader world. As we enter the holiday

The Impact of Elections on the Markets and Tax Policy With Labor Day behind us, we’re in the final stretch of the 2024 presidential election race. As we follow the

I’m not sure about your family, but when October ends, my family immediately starts turning attention toward the rush of the holiday season. Between my immediate and close extended family, we

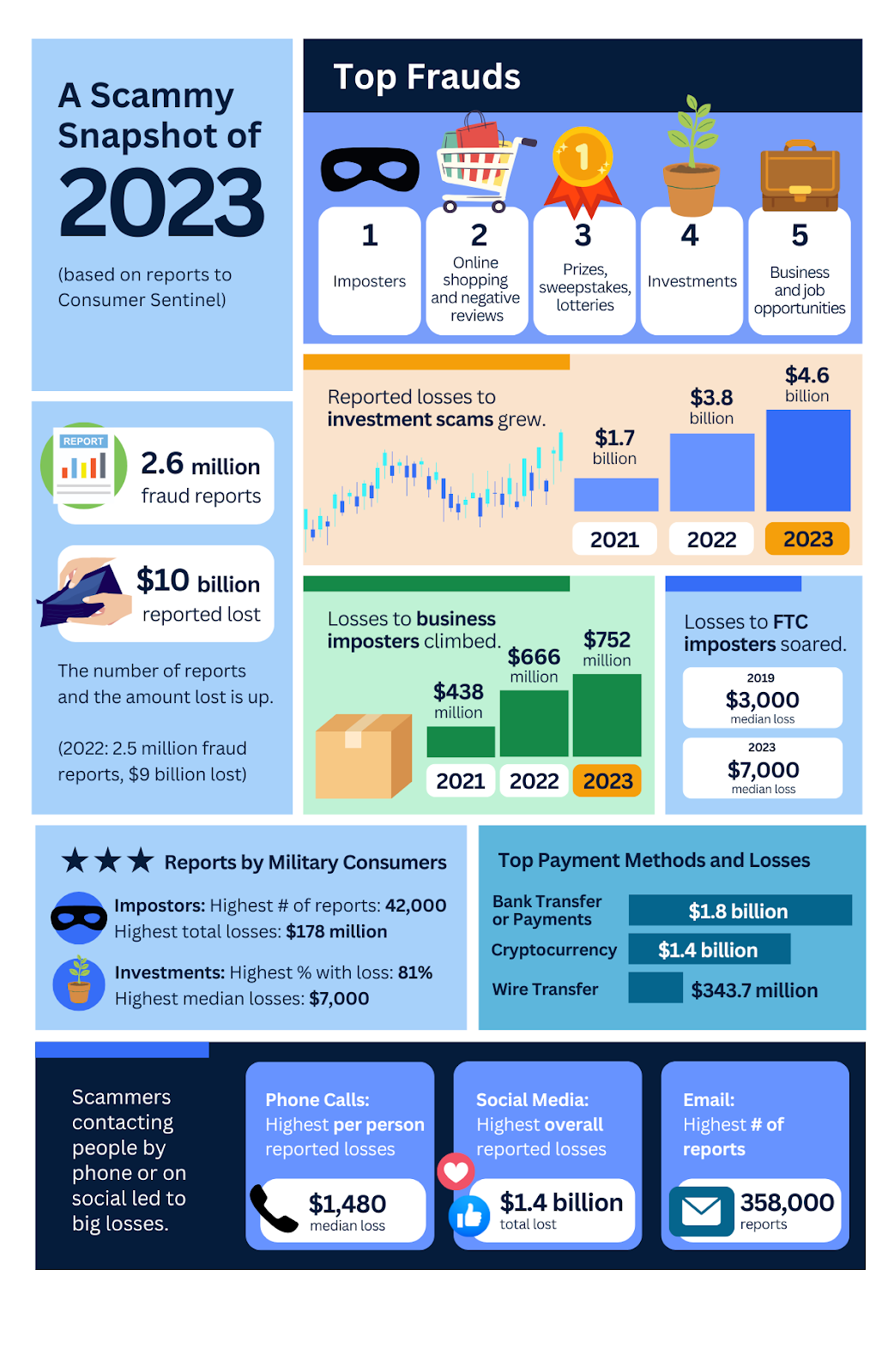

Unfortunately, summer is coming to a close which means we are more than halfway through 2023. While you take the last moments to soak up the sun, now is also

On May 22, 2023 I received an email from Charles Schwab. It was titled in all caps, “IMPORTANT TAX RETURN DOCUMENT AVAILABLE – Form 5498,” and I got a similar

As 2023 continues to fly by, it’s important to take note of the updated retirement account contribution limits for 2023. These limits are set by the Internal Revenue Service (IRS)