Before the Ball Drops: 7 Financial Tasks to Complete Before Year-End

As the end of the year approaches, now is the perfect time to review your finances and make strategic moves that can strengthen your financial position heading into 2026. Our

Our blog offers insights, strategies, and practical tips to help you achieve financial freedom—no matter your unique financial situation.

As the end of the year approaches, now is the perfect time to review your finances and make strategic moves that can strengthen your financial position heading into 2026. Our

The rules regarding inherited IRAs have changed in the last five years, and failing to comply with the new requirements may result in IRS penalties. These changes affect people inheriting

You’ve likely spent years building your retirement nest egg—saving diligently, investing wisely, and contributing to retirement accounts along the way. But transitioning from earning a paycheck to relying on your

March is Women’s History Month, and according to a recent survey, 49% of women consider themselves to be the chief financial officer of their households, up from 41% in 2021.1

You’ve worked hard throughout your life to build assets to support your retirement. As financial professionals, one of the most critical functions we provide is helping clients determine their retirement

I’m not the main cook in our house (I give my wife full credit for putting amazing meals on the table every day!), but I do love to eat—and cook.

Social Security is often misunderstood or underestimated in retirement strategy. However, as financial professionals, we’ve seen how it can play a crucial role in our clients’ overall financial strategy, regardless

As you approach retirement, a critical aspect of your retirement strategy can catch even the most financially savvy individuals off guard: healthcare costs. For decades, you may have enjoyed employer-sponsored

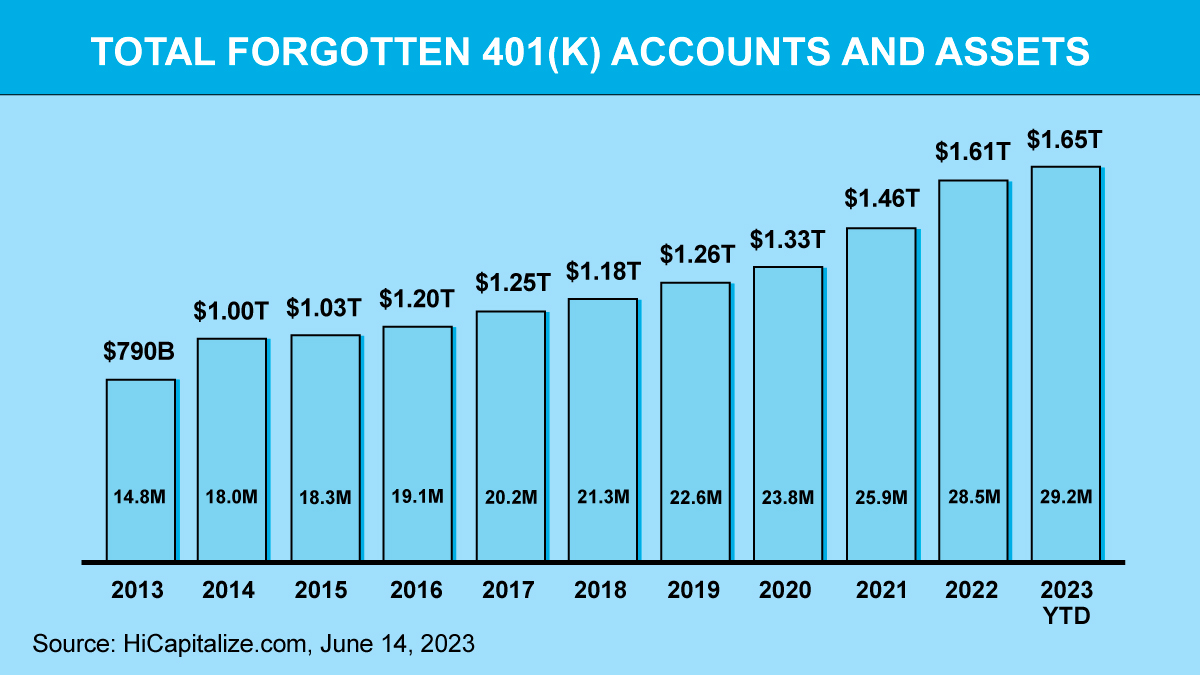

If you think the United States has a retirement crisis, you are not alone. A recent survey found that 79% of working-age Americans believe the same thing. That percentage is

A few years ago, there were ads from financial services companies asking, “What’s your number?” The number was the money you needed to retire comfortably. This was an effective way

The Secure Act 2.0, pieces of which become effective in 2024, significantly alters the retirement planning landscape, especially for high-net-worth individuals. As a financial planner specializing in this clientele, I’m

Unfortunately, summer is coming to a close which means we are more than halfway through 2023. While you take the last moments to soak up the sun, now is also