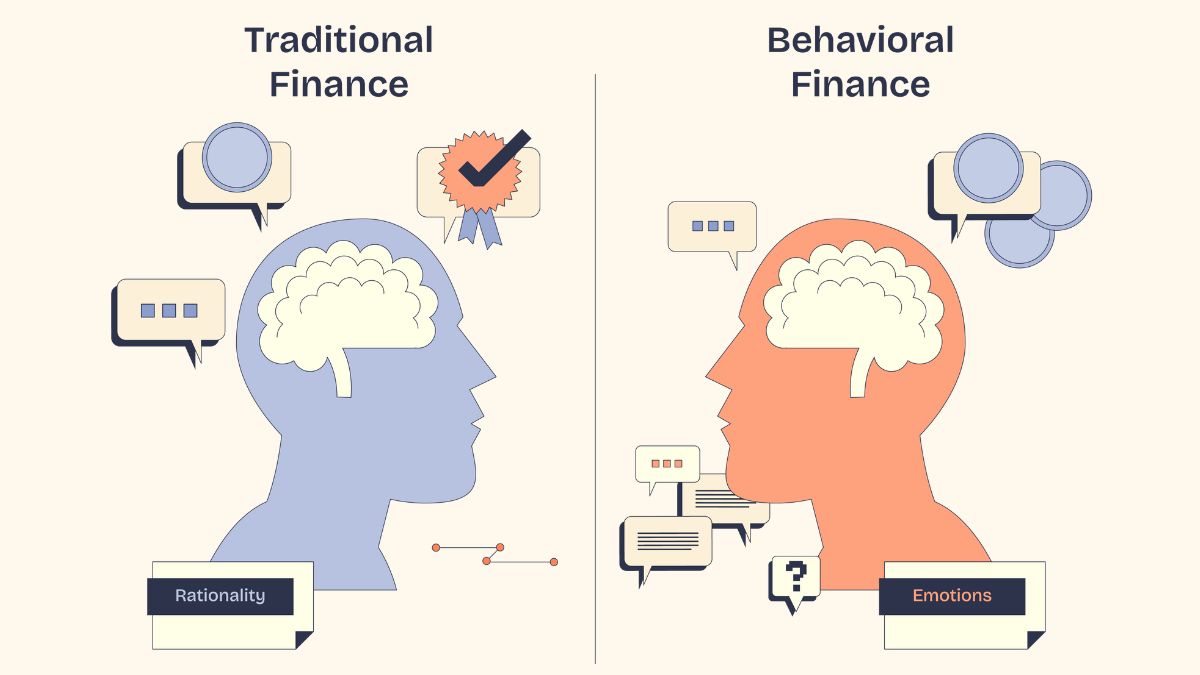

Understanding the Emotions Behind Financial Decisions

February is an interesting month in the financial calendar. The holiday excitement has faded, credit card bills from December have arrived, and tax season is in full swing. For some

Our blog offers insights, strategies, and practical tips to help you achieve financial freedom—no matter your unique financial situation.

February is an interesting month in the financial calendar. The holiday excitement has faded, credit card bills from December have arrived, and tax season is in full swing. For some

Despite those who say the conventional wisdom that has guided investor actions over the years is no longer valid in 2025, remember the famous quote from legendary investor Sir John

As we approach the end of 2024, it’s an opportune time to reflect on the year’s financial developments and consider what 2025 may bring. We believe in understanding both the

The Impact of Elections on the Markets and Tax Policy With Labor Day behind us, we’re in the final stretch of the 2024 presidential election race. As we follow the

In 1999, Bill Gates wrote, “How you gather, manage, and use information will determine whether you win or lose.” Companies looking to be successful in the future should heed these words

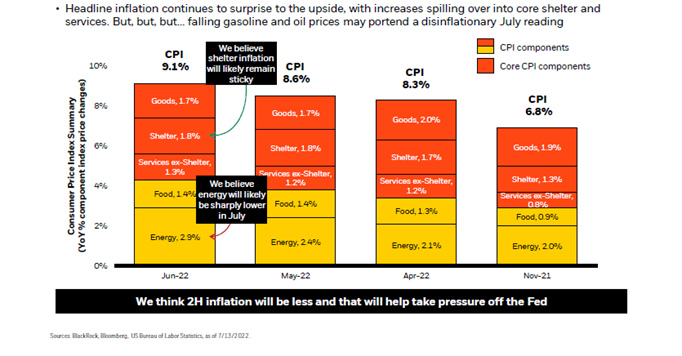

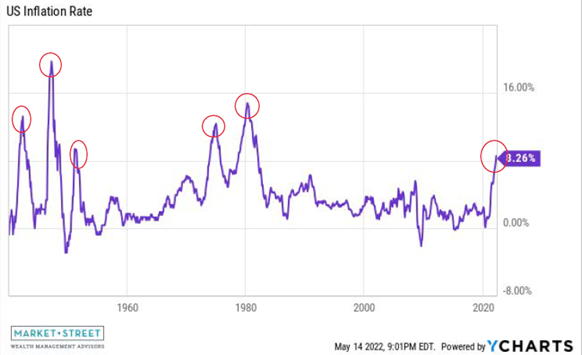

If you read Kyle Thompson’s blog on March 14th of this year and recall that it began with “The start of 2022 has been volatile”, that recollection might make you

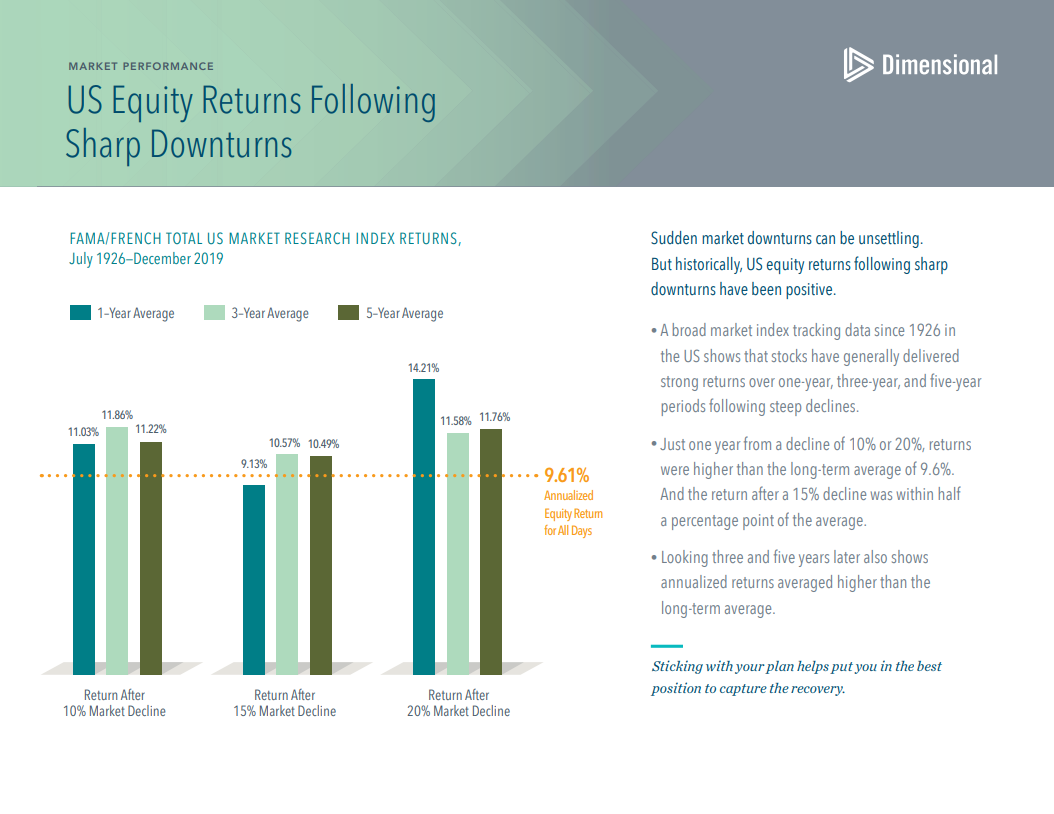

“The stock market is a device for transferring money from the impatient to the patient” – Warren Buffett Buffett has many timeless quotes, but there are none that ring truer

Last Thursday, February 24th, Russian President Vladimir Putin ordered a “special military operation” in Ukraine early in the morning. News of that order was quickly followed by reports of explosions

“Be fearful when others are greedy and greedy when others are fearful.” – Warren Buffett This is one of my favorite investing quotes as it has proven accurate throughout history

At Market Street, we do not believe in speculating or market timing. We base our asset allocations and investment recommendations on long-term historical analysis which can be supported by evidence-based

I’m not typically a New Year’s resolutions kind of guy. Not only do I like to think I walk a pretty disciplined path (I eat a fairly healthy diet, I

“The important thing about an investment philosophy is that you have one you can stick with” – David Booth, Co-founder of Dimensional Fund Advisors. Happy New Year! I hope the