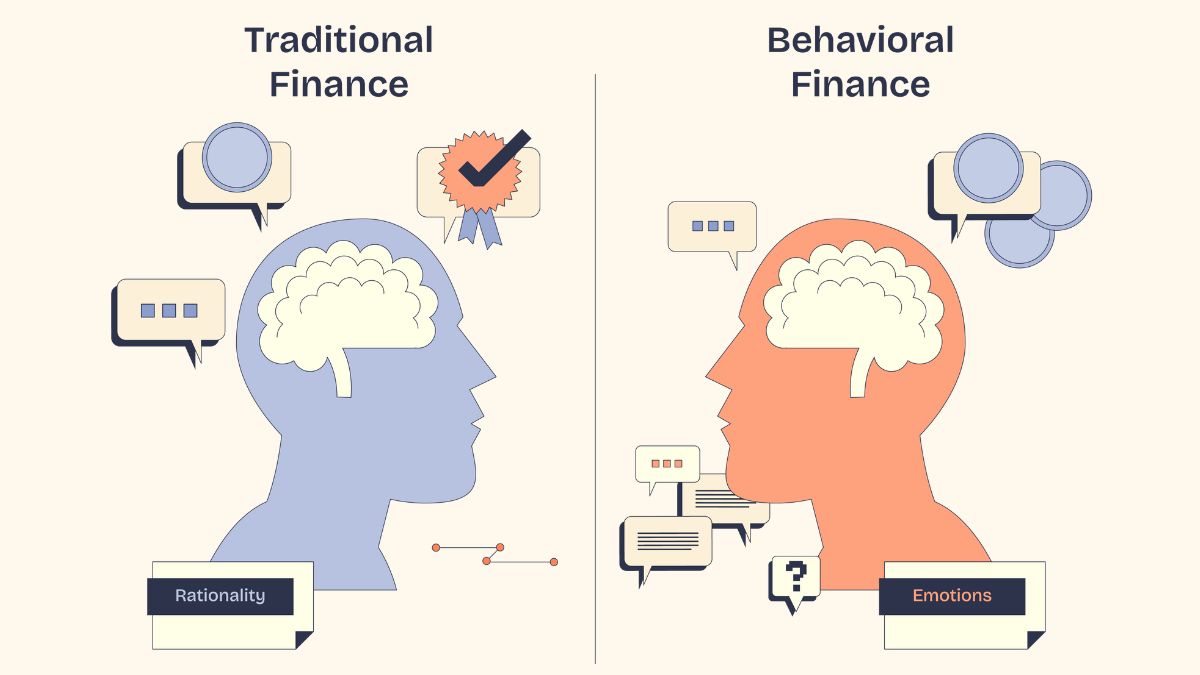

Understanding the Emotions Behind Financial Decisions

February is an interesting month in the financial calendar. The holiday excitement has faded, credit card bills from December have arrived, and tax season is in full swing. For some

Our blog offers insights, strategies, and practical tips to help you achieve financial freedom—no matter your unique financial situation.

February is an interesting month in the financial calendar. The holiday excitement has faded, credit card bills from December have arrived, and tax season is in full swing. For some

Artificial intelligence (AI) may be the most revolutionary technology of our time, with industries scrambling to embrace its possibilities. AI’s early influence seems similar to the positive disruptions brought about

As we begin a new year and consider the opportunities ahead, reflecting on the past year helps put today’s financial landscape into perspective and informs the strategies that can move

As the end of the year approaches, now is the perfect time to review your finances and make strategic moves that can strengthen your financial position heading into 2026. Our

As you gather with family for the upcoming holidays, a growing number of Americans may discuss caring for aging parents around the dinner table. As financial professionals, we have many

Why Talk About Money During the Holidays? As you gather with family around the holidays, it may be a good opportunity to discuss a potentially uncomfortable, but necessary topic: family

Receiving a bonus, inheritance, or an increase in income often prompts a key financial question: Should I use this money to pay off my mortgage, or invest it? At first

If you’ve found yourself stepping into a more active role in your parents’ financial lives, you’re not alone. Some of us are helping aging parents navigate everything from healthcare decisions

The final months of the year can sneak up quickly, and with them come deadlines, decisions, and distractions. Before the holiday season takes over your calendar, fall can be a

On July 4th, Congress passed the One Big Beautiful Bill Act (OBBBA), a sweeping new tax law that reshapes many deductions, credits, and planning strategies for individuals, families, and business

Estate management isn’t just about what happens after you’re gone— it’s also about what you can do now to help manage future estate taxes, transfer wealth strategically, and attempt to

The rules regarding inherited IRAs have changed in the last five years, and failing to comply with the new requirements may result in IRS penalties. These changes affect people inheriting