Market Update and Trade Notice (Q2 2023)

It seems like the stock market has also decided to take part in March Madness this year. As we shared in last week’s Banking Crisis letter the markets have been rattled by the Federal Reserve’s continued hawkish tenor as well as the recent banking failures of Silicon Valley Bank, Signature Bank, and Silvergate Capital. While I continue to believe these are idiosyncratic events, they have, nonetheless, had a ripple effect on both domestic and global financial markets.

I want to be clear that we do not see anything today that makes us believe we will experience the financial sector strain that we saw during the Great Financial Crisis (GFC). We feel that the lessons learned during the GFC coupled with the swift action of the Federal Reserve, FDIC, and Treasury to restore consumer confidence around the recent banking failures will allow this crisis to pass with little disruption to the banking system.

Nonetheless, it has become evident that cracks are forming from the most aggressive interest rate hike cycle we have seen since the early 80’s, which could delay the economic recovery. Therefore, we felt it was necessary to make defensive tactical shifts while the Fed continues to balance lowering inflation without shuttering economic growth.

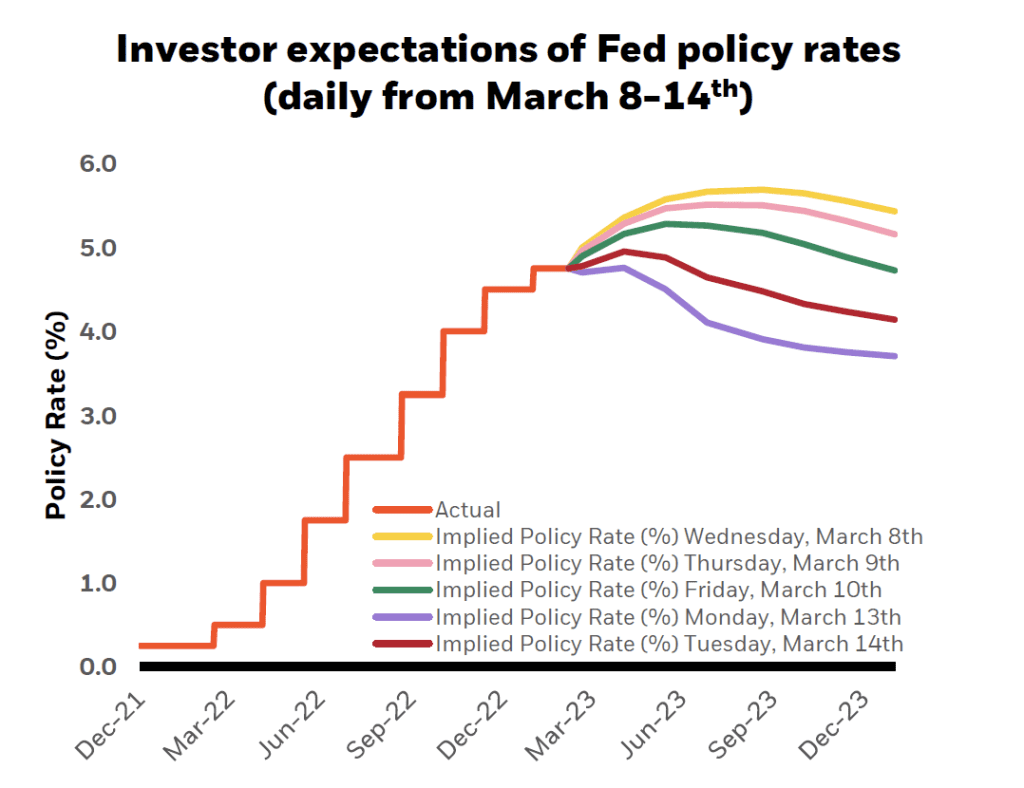

It is likely the events over the past couple of weeks will force the Fed to pause their overly hawkish actions. This belief is supported by the action we saw in the bond markets last week which is indicating the rate hike campaign may be nearing an end. The markets went from expecting another 100bps (1%) rate hike to now pricing in 100bps (1%) cut by year-end. This is a 200bps swing, which is unprecedented territory but also highlights the level of market uncertainty we are currently face.

Trade Notice

We will be implementing trades in your portfolio to remove active risk while keeping our long-term strategic allocation in focus. Below is a quick summary of our upcoming repositioning.

- Move from 1% overweight in stocks to a 1% underweight (for example a 50% stock/50% bonds and cash portfolio will now target 49% in stocks), with increased emphasis on greater quality and resilience across portfolios.

- Move out of positions that carry more active risk (momentum stocks, small cap, and emerging market stocks). Small cap names could have a harder time obtaining financing as banks start to tighten lending.

- Move our overweight exposure from value to growth names (growth stands to rally as rates begin to fall).

- In fixed income we are increasing quality while maintaining a slight overweight to duration. We feel that intermediate maturities will have the greatest returns as we transition from the increasing interest rate cycle.

Trade Implementation:

These trades will be made in our client qualified accounts (IRA, Roth IRA’s) early this week. We will extend this to taxable accounts over the next couple of weeks as we balance portfolio repositioning with capital gain exposure. We always keep taxes front and center so we will not be taking undue capital gains in situations where the repositioning does not enhance a client’s total return opportunity.

Summary:

Carl Richards wrote “Risk is what’s left over after you think you’ve thought of everything.” This quote rings true today. At the beginning of the year, it appeared the Fed was effectively winning the war on inflation (albeit slower than desired) while also navigating a soft landing. To my knowledge, no one had banking failures on their list of worries. Today, news and information comes at us quickly and we feel it is in our clients best interest to adjust when the data changes.

Our long-term view of “buy and hold” will never be compromised but we do firmly believe that the markets provide short-term tactical opportunities where we can either shave or add to our active risk within our portfolios. Given the stresses that were recently placed on the banking system and the likelihood that banks will begin tightening their lending requirements it seems reasonable for us to de-risk as the probability of an economic slowdown has increased.

We will continue to be data dependent and will be ready to pivot, in the future, when the data and information warrants a shift back.

We thank you for your continued trust in us and your patience as we have navigated some trying markets over the past two years. If you have any questions, please feel free to respond to this email or reach out to your trusted advisor. We look forward to continuing to serve your financial planning and investment needs and are honored to work alongside you!

WANT TO RECEIVE UPDATES TO YOUR INBOX?

Sign up for our newsletter